Deep Dive: Step Finance

One stop for portfolio tracking, insights, defi degening and community happenings.

Introduction

So you got introduced to this cool new crypto thing by your degen friend, you are bombarded with ads everywhere by crypto exchanges, and you saw how age-old tradfi orgs suddenly started shilling cryptocurrencies earmarking it as the future of finance.

Finally, you decided to get into it, with clever marketing and a slightly better user experience the centralised exchanges convinced you to use them for all your trading needs, bought high sold low becoming a true degen and then the inevitable happened…(image unrelated)

This is when you along with a lot of early adopters understood the importance of self-custody and decentralized finance(defi). Self-custody is the soul around which the whole crypto movement is built.

Not your keys, not your coins

After getting your keys, a wallet app and transferring your coins. You escaped the high gas fees of Ethereum and the complicated bridges for L2s by using Solana. You think you are now all set to enter the self-custody defi realm. However, you soon realize the mess you are getting into.

It is very difficult to keep track of your portfolio its ups and downs, at the same time decentralisation also means rapid permissionless innovation, henceforth there are a lot of defi protocols with complicated mechanisms which can be tough to navigate. Also, the permissionless nature of crypto means that the rate of change is rapid, hence it is crucial to remain ahead of the curve(we call it ‘alpha’) without losing sight of the bigger picture.

Enter the hero of our story Step Finance, the front page of Solana.

Step Finance offers a decentralized portfolio visualization application. It aggregates all assets contained in your wallet, displaying the tokens (including NFTs), their sizes, and the activities performed with the cryptocurrencies in the wallet, such as farming and staking.

Now you don’t need to visit each project's website individually and log in to track token and LP balances, current position sizes, and overall portfolio performance.

Beyond visualising, you can also execute transactions across many Solana contracts in one place, this is the power of interoperability which blockchains offer.

Step Finance's analytics provides insights into price movement, market cap, and transaction volume through DEXs, giving you an understanding of what is happening in the ecosystem.

Step Finance is also known for its quality content production. There is something for everyone from a podcast for people who are new to Solana to deep data analysis to gain new insights for degens.

Step Data Insights, its data analysis arm, offers regular newsletters and quarterly ecosystem data.

The Next Billion podcast focuses on the builders and entrepreneurs onboarding the next billion people into crypto.

SolanaFloor, acquired by Step Finance, is a news website for Solana about token distribution, price development, and NFT data.

Together, these platforms provide a comprehensive view of the Solana ecosystem, making it easier for users to navigate the world of crypto.

Solana Crossroads and Solana Allstars are two initiatives under the Step Finance brand that aim to foster community and inclusivity within the Solana ecosystem.

Solana Crossroads is an annual conference that brings together the brightest minds in crypto for networking and collaboration, while Solana Allstars is a decentralized community that focuses on inclusivity and has organized numerous events and meetups worldwide. Both initiatives play a crucial role in expanding the reach of Solana and fostering a vibrant and inclusive community.

Recently launched Step DAO is a decentralized autonomous organization associated with Step Finance.

Step DAO sponsors bounties for both technical and non-technical work, paid in STEP tokens, for initiatives that further the core goals of the Step community.

We will look into every offering by Step Finance in detail next and how it can help you become a better on-chain citizen.

Defi overview

This is a general overview of all the heavy defi terms you would usually see thrown around. Feel free to skip this part if you already know.

Automated Market Makers (AMMs) are protocols that enable decentralized trading and provide liquidity for assets. Liquidity Providers (LPs) are individuals who supply funds to AMMs to facilitate trading and are rewarded with fees and other incentives.

In Solana, Raydium is an example of an AMM and liquidity provider. It allows users to provide liquidity to various pools and earn rewards in the form of transaction fees and native tokens. Yield farming, a common practice in DeFi involves staking or providing liquidity to generate rewards.

Decentralized exchange (DEX) aggregators like Jupiter source liquidity from multiple Solana DEXs, such as Orca and Raydium. It functions as a one-stop platform for users to find the best swap prices and execute trades across various tokens.

Step Finance Dashboard

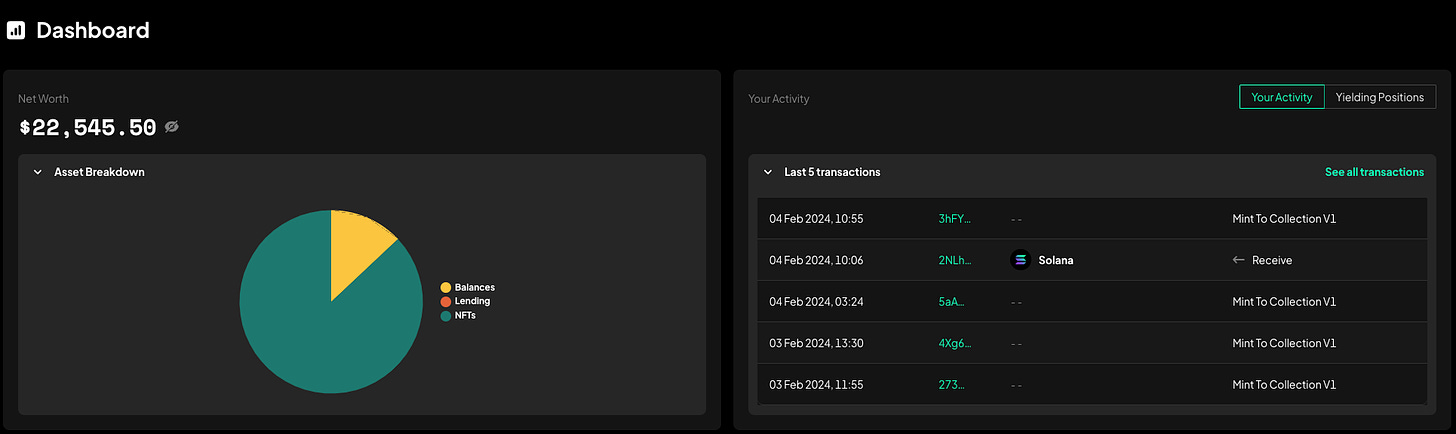

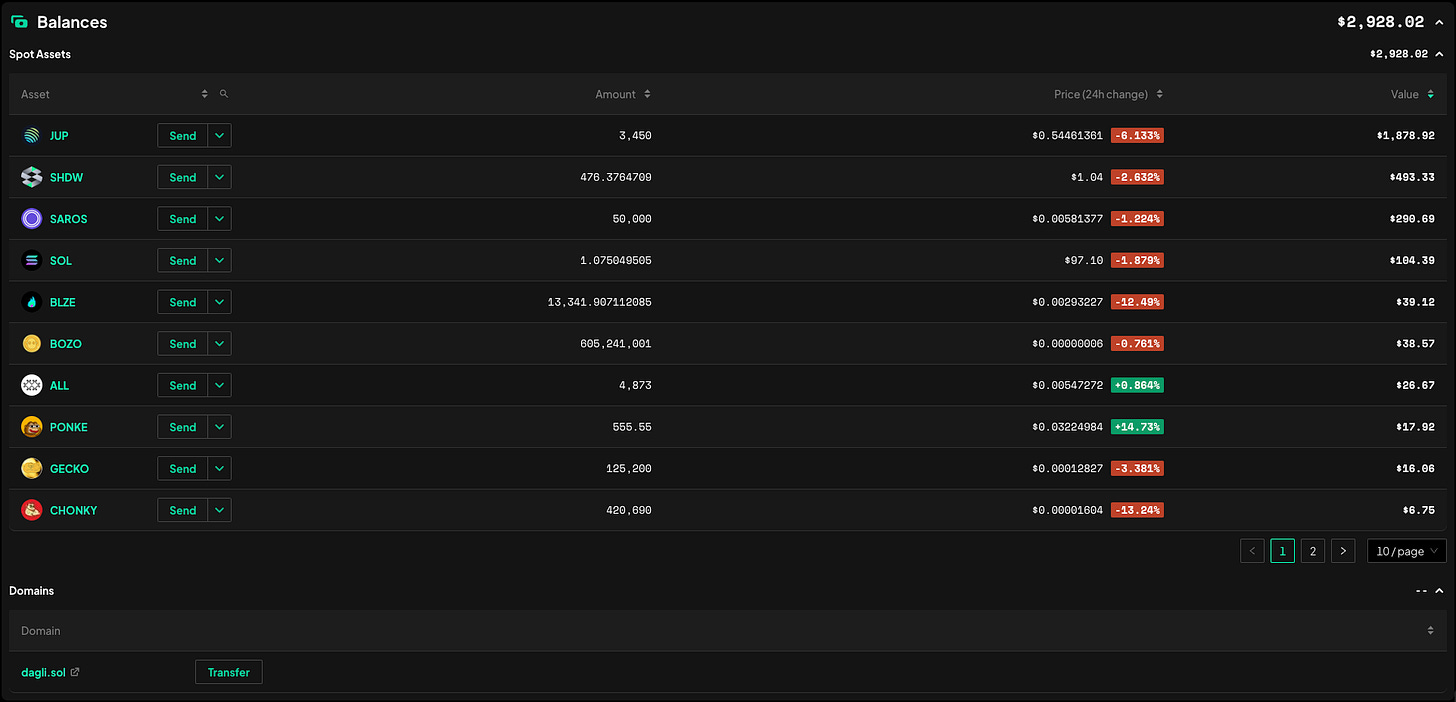

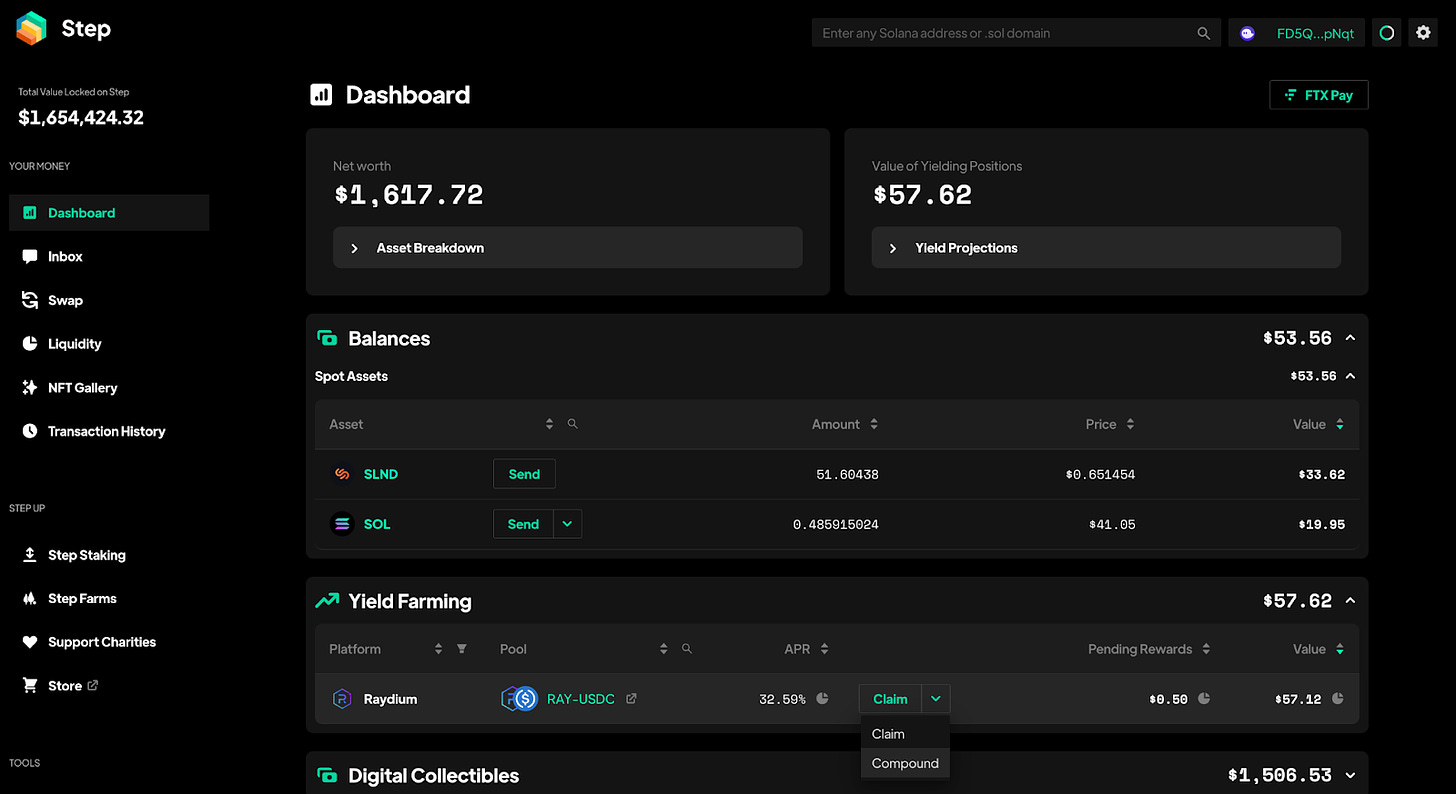

Step Finance offers a comprehensive dashboard to monitor portfolio token balances, AMM LPs, yield farms, and more, covering about 95% of the Solana ecosystem. Step indexes data directly from the blockchain, providing users with a detailed breakdown of their positions and balances associated with their wallets.

Here's a general breakdown of the features you would find on the Step Finance dashboard:

Portfolio Overview: This section provides a detailed breakdown of all positions and balances associated with the user's wallet. It includes token balances, LP positions, staked tokens, and NFTs.

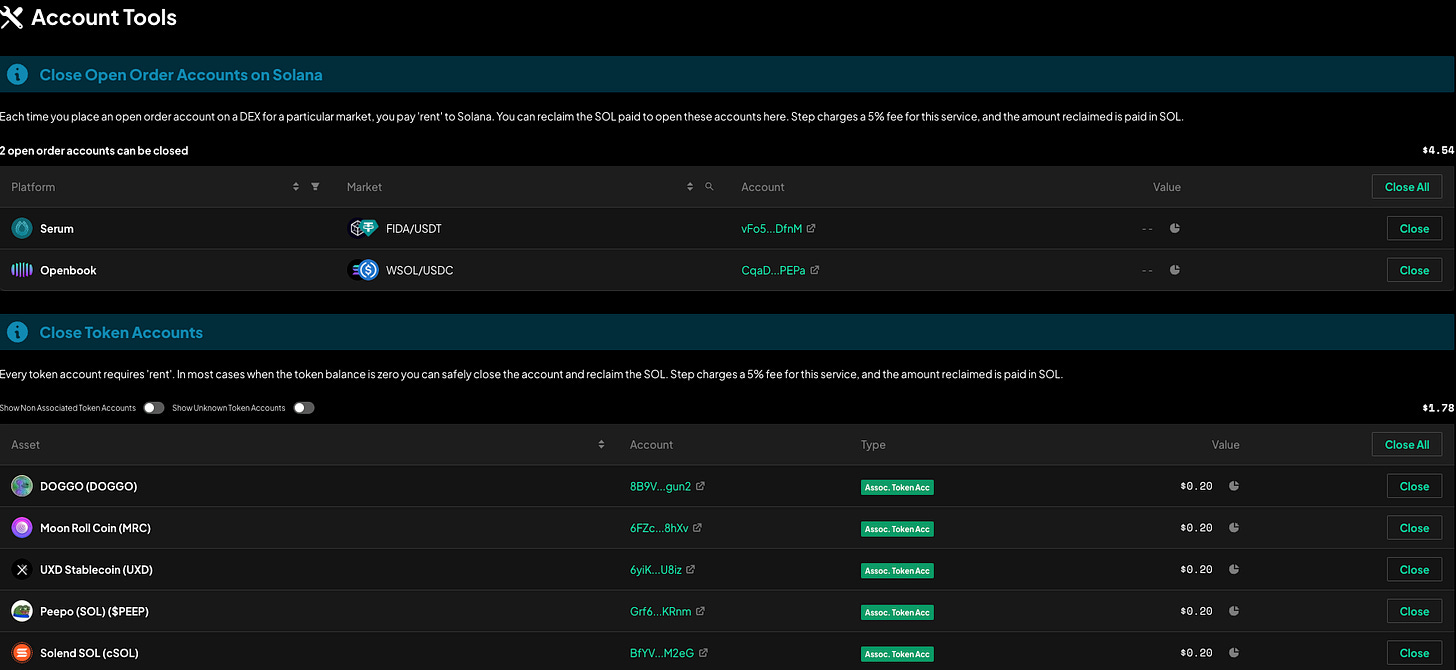

Protocol Integrations: Step Finance is integrated with various protocols within the Solana ecosystem. This allows users to manage their positions, such as claiming and compounding yield farm rewards or closing open orders on DEXs, directly from the dashboard.

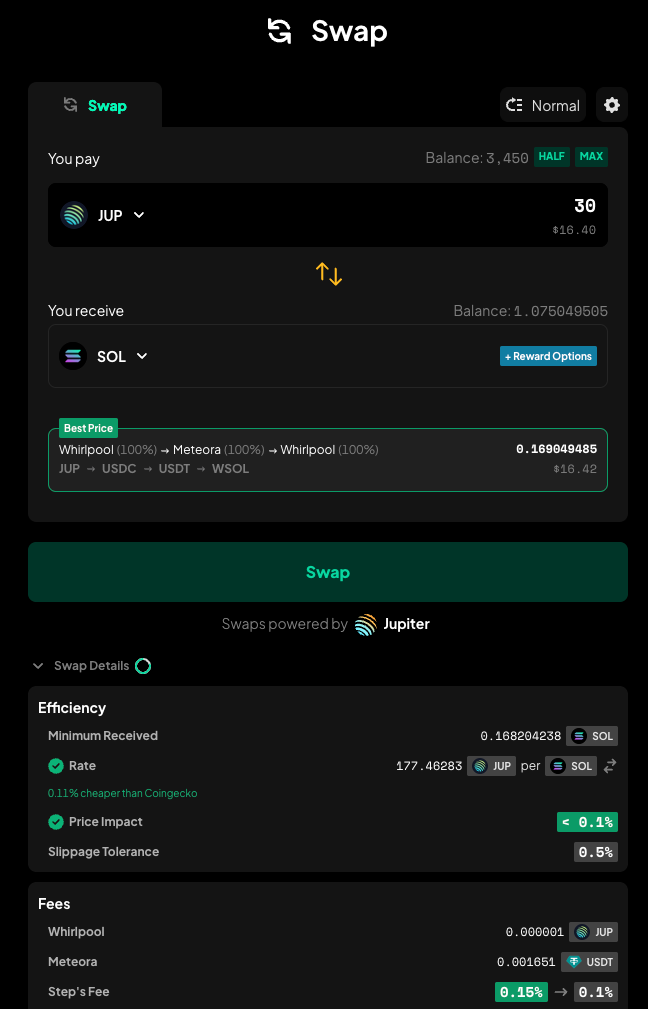

Claiming or compounding LP rewards(source) Swaps: Integrated with Jupiter Exchange, swap enables users to swap tokens directly from the dashboard. Using an aggregator like Jupiter means users have a wide range of token trading pairs and low fees paired with rewards

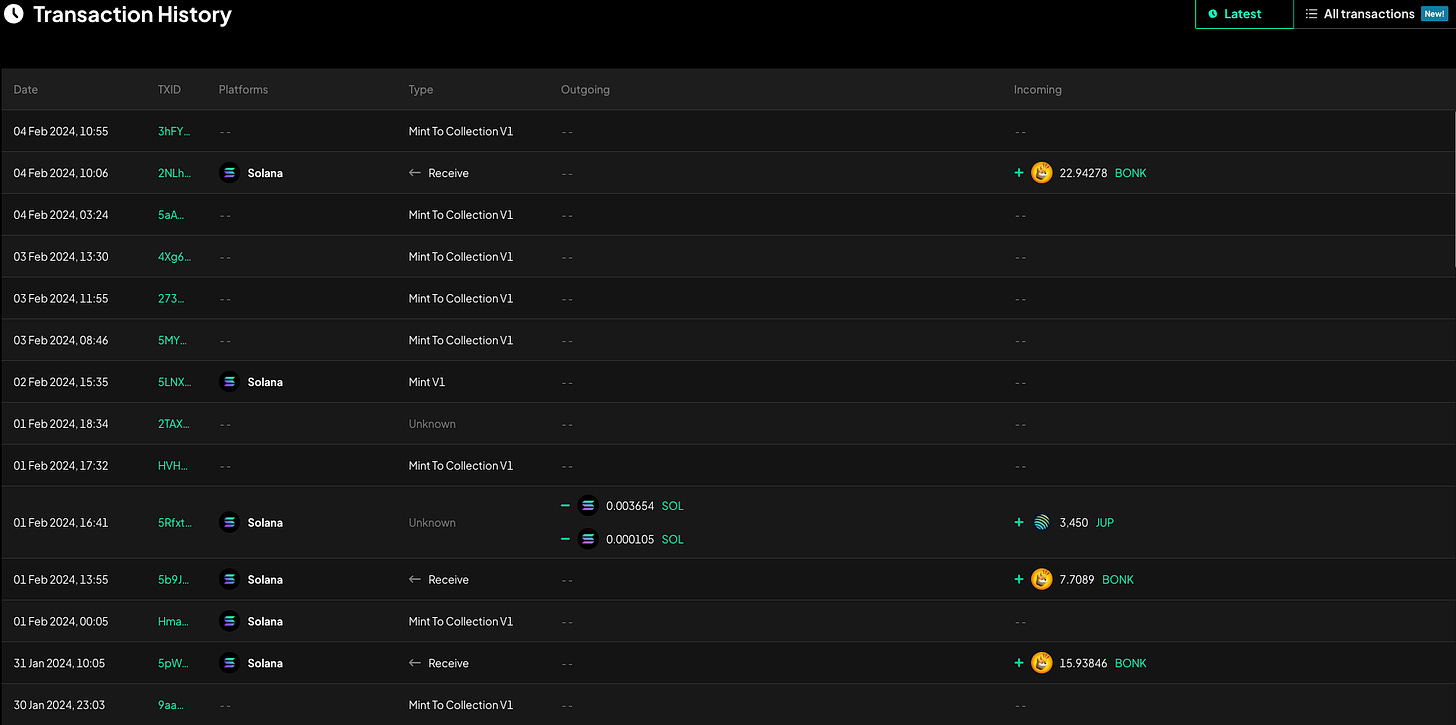

Transaction History: To track wallet transactions.

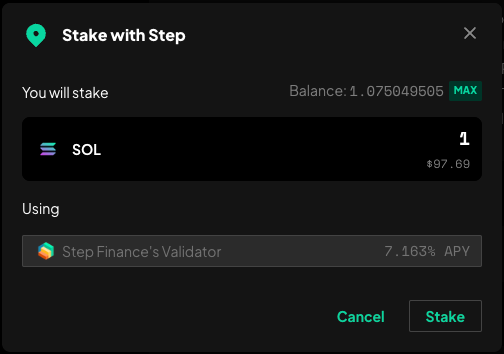

Staking: Users can stake their STEP tokens and SOL to Step Finance’s validator directly from the dashboard. Once staked, the tokens can earn a share of Step's revenue. More on this later.

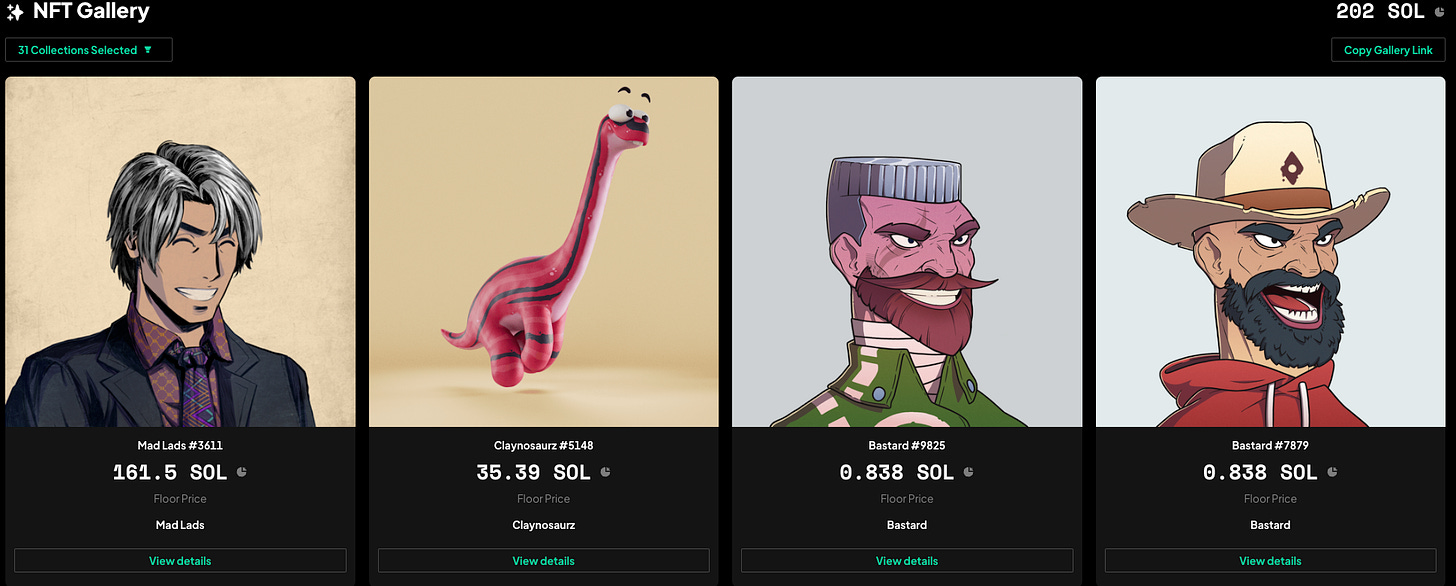

NFTs: Step offers one of the best views of you losing money…sorry, I mean your NFT collection. It provides a nice comprehensive overview of all your NFTs. It also gives details on particular NFTs, their attributes, description and other details.

The Step Finance Dashboard serves as a comprehensive and user-friendly platform to manage your crypto assets, offering real-time insights into your portfolio, seamless protocol integrations for swaps and staking, and tools to explore DeFi opportunities, thereby streamlining the user experience in DeFi.

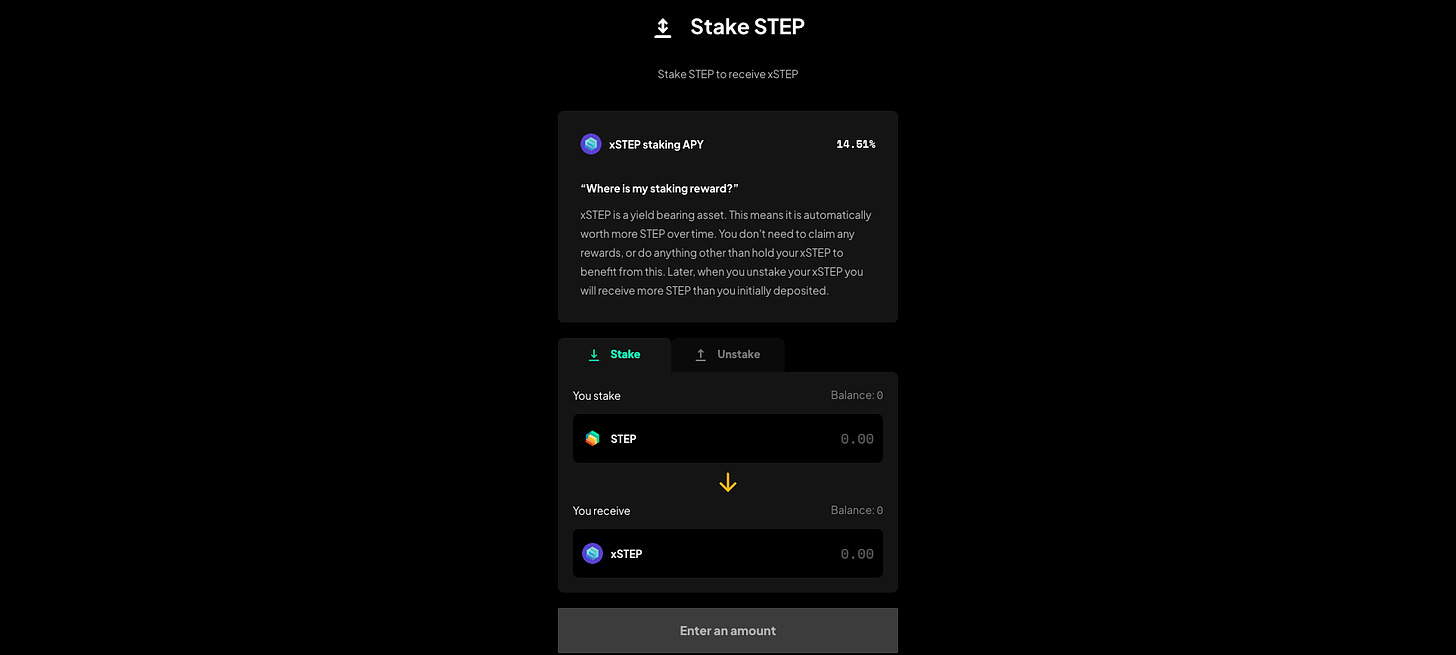

Staking Step

Staking STEP tokens is a way for holders to earn rewards from the revenue generated by the Step Finance protocol.

Here's a simplified breakdown of how it works:

Staking STEP: When you stake your STEP tokens, you receive xSTEP tokens in return. These xSTEP tokens represent your share of the staking vault. xSTEP is a tradable token on the Solana blockchain. It represents a proportional claim on the STEP tokens and the accumulated fees in the vault.

Earning Rewards: The Step Finance protocol charges fees for using its products. These fees are collected and sent to the staking vault.

Value Growth: The value of xSTEP grows over time as more fees are added to the vault. This means that the amount of STEP you can get for your xSTEP increases.

Unstaking: When you want to get your rewards, you simply unstake your xSTEP. You'll receive more STEP tokens than you originally staked, based on the current value of xSTEP. You don't need to claim your rewards separately. The reward distribution happens automatically when you unstake.

APY Calculation: The Annual Percentage Yield (APY) shows how much the value of xSTEP could increase over a year. For example, if 5,000 STEP is added to the vault which already has 10,155,788 STEP staked, the APY would be calculated as follows: APY=(5,00010,155,788)×365×100=17.97%APY=(10,155,7885,000)×365×100=17.97%.

In summary, by staking STEP, you're essentially lending your tokens to the Step Finance protocol to earn a share of its revenue. Your rewards accumulate in the form of xSTEP's increasing value, and you can cash out anytime by unstaking. This system is designed to be simple and automatic, with no need for manual reward claims.

For more details on STEP Staking, go here.

Step Analytics

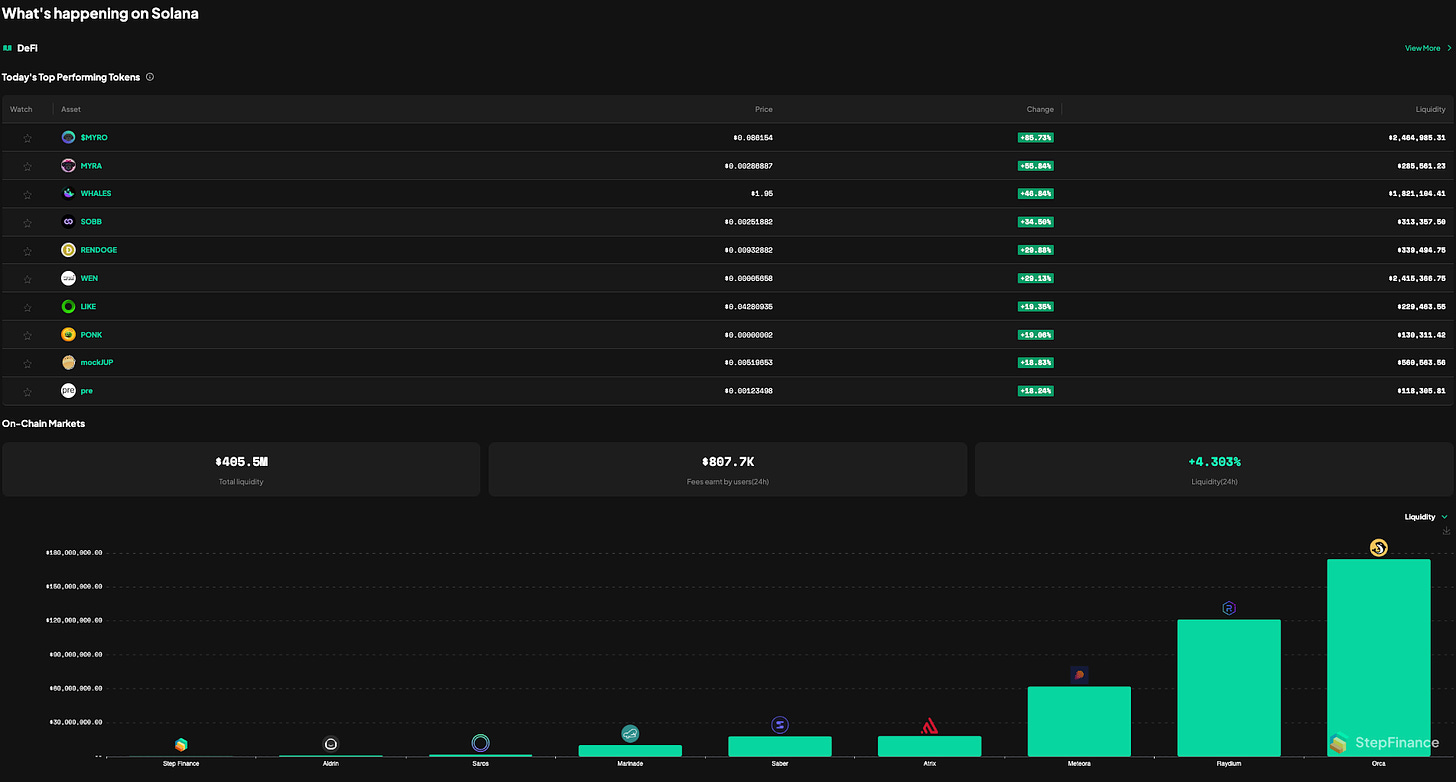

Step Analytics is a performance dashboard that provides insights into the activities happening in the Solana DeFi ecosystem.

Here are some of its salient features:

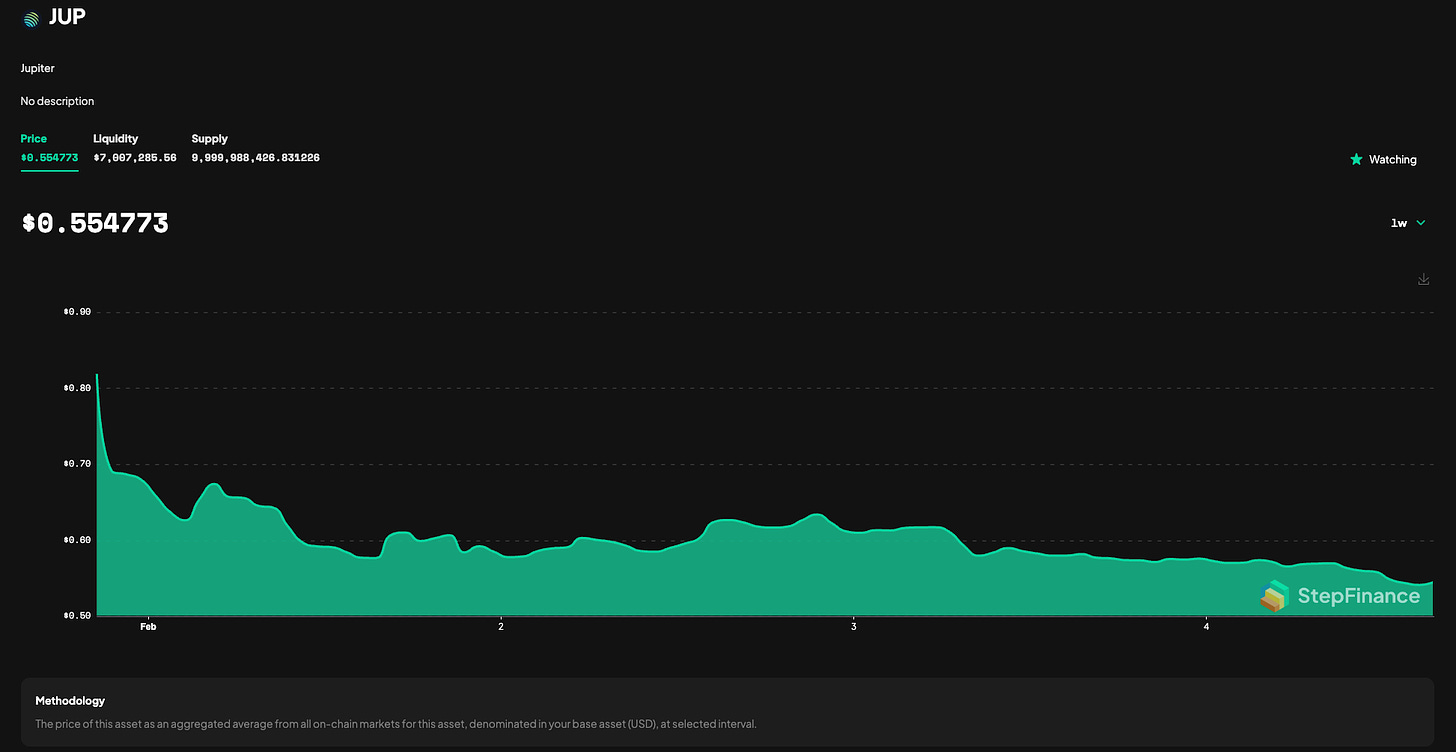

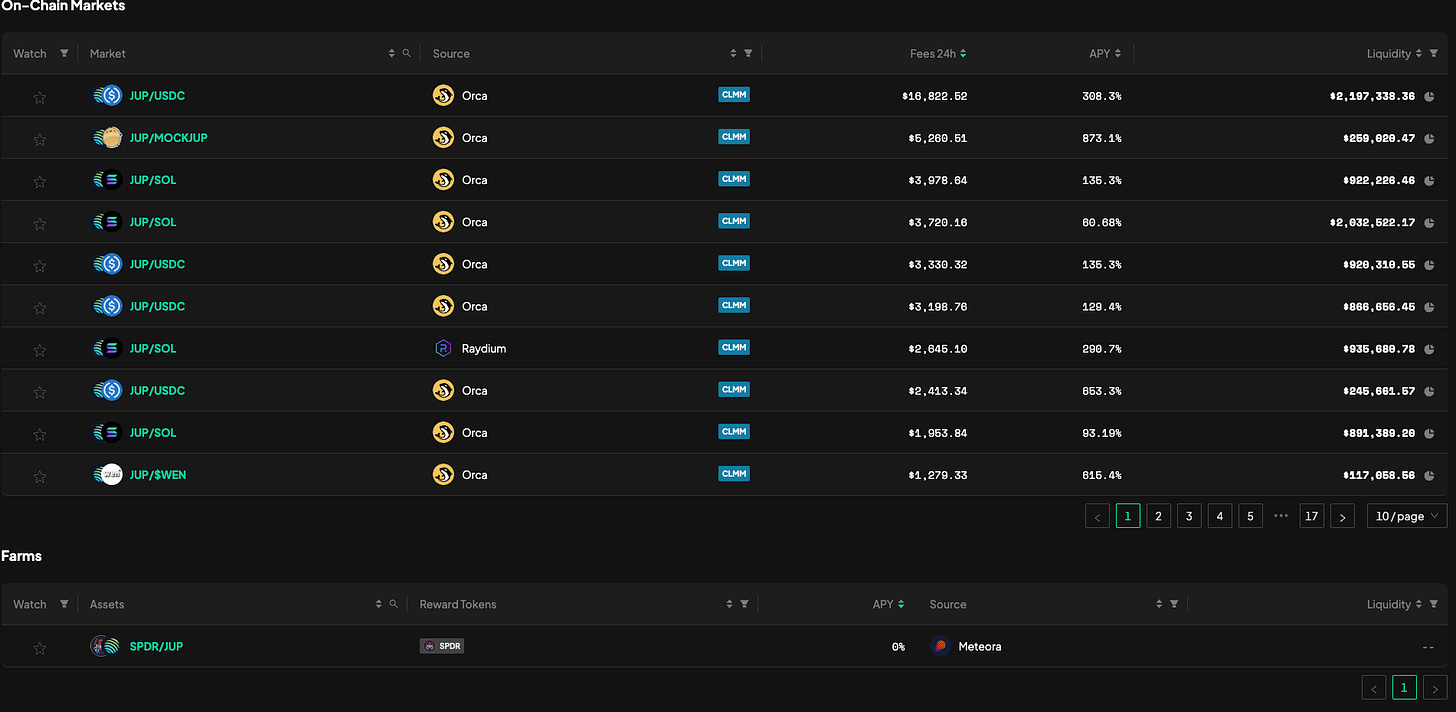

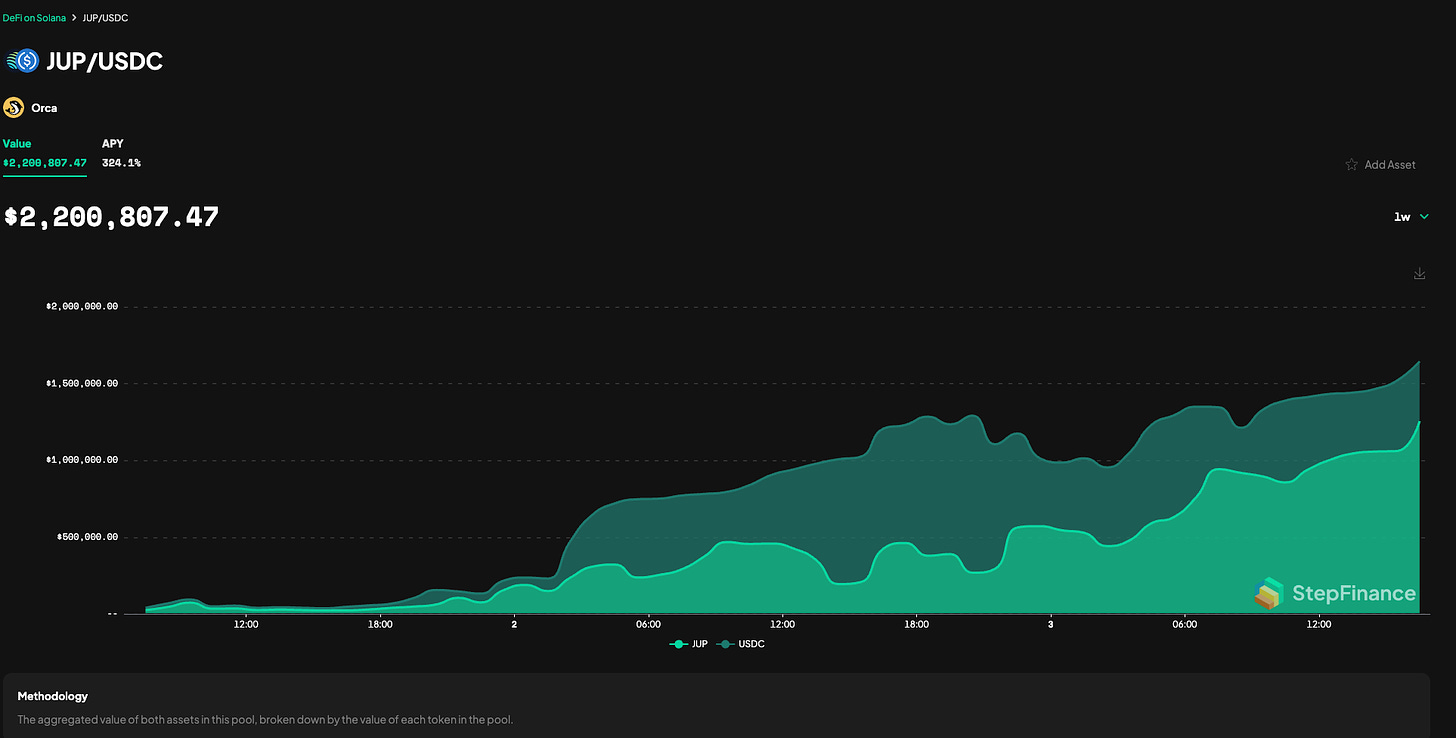

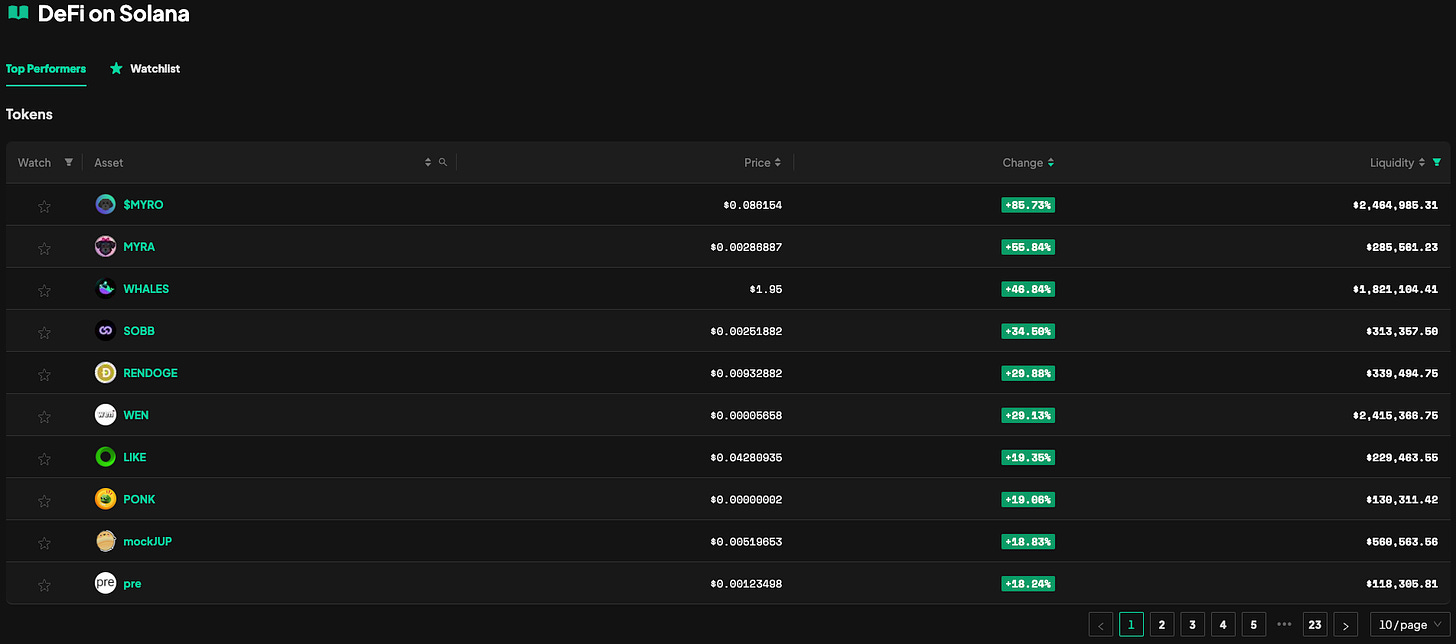

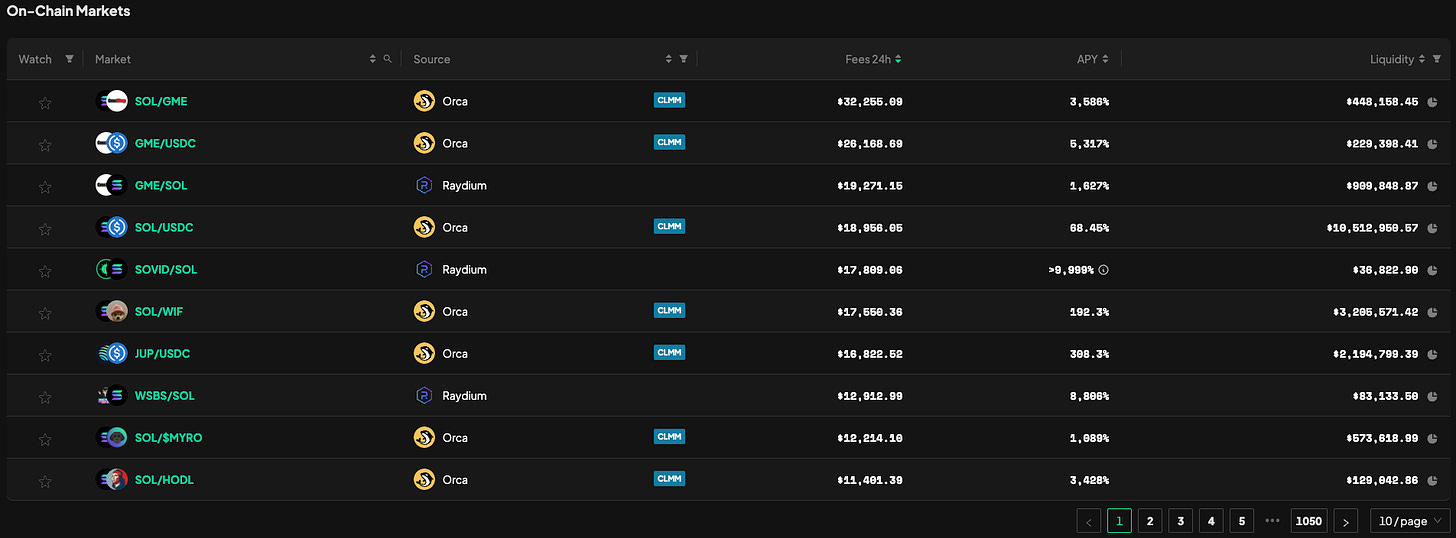

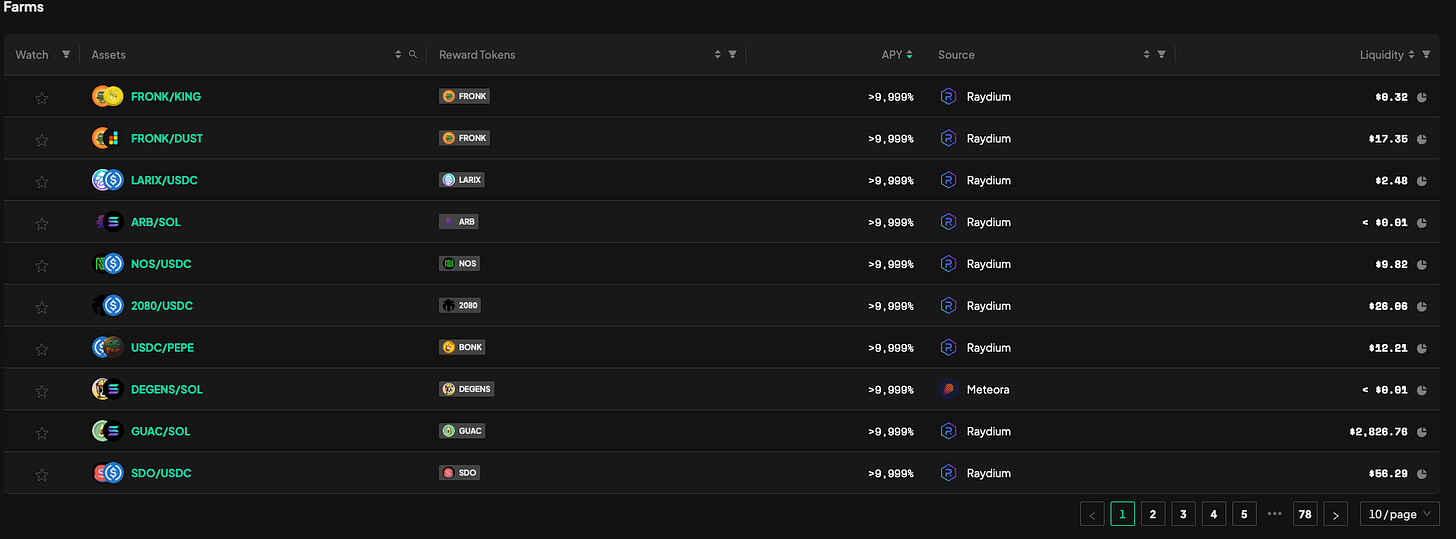

Performance Dashboard: A comprehensive dashboard that displays the performance of various tokens on the Solana blockchain. It provides historical price, liquidity and Supply for almost all SOL tokens. Additionally, it provides a detailed overview which includes liquidity and APY of all the on-chain markets and farms for a particular token.

On-Chain Markets Data: Data on on-chain markets. The data includes historical TVL and APY for a particular on-chain market. The dashboard also provides a convenient breakdown of reward tokens and the actual APY.

Top Performing Tokens, Markets and Farms: Step Analytics also highlights the top-performing tokens, markets and Farms on the Solana blockchain for any given day. This is a go-to page for degens who want those juicy rewards and always stay ahead of the market

DeFi Activity Overview: An overview of what's happening in the Solana DeFi ecosystem. This includes information about new projects, significant transactions, and other relevant activities. Truly the front page of Solana.

Along with this Step also provides a detailed overview of all Solana network-related data which includes TPS, transactions, active wallets and many more things. You can check it out here.

One of my favourites is the watchlist feature, you can add any token, farm or market to your watchlist, this helps in personalisation and easy tracking of your favourite stuff on-chain.

Step Data Insights

The Step Data Insights Newsletter focuses on providing data-driven insights into the Solana ecosystem. It has 1,000 subscribers and covers a range of topics including DeFi, NFTs, validators, and more, to inform readers based on data rather than opinion.

Posts discussing upcoming Solana airdrops are some of the most popular ones, indicating a high level of degeness for free token distribution within the Solana community.

Another popular post debunked the myth that Solana has a small developer base, using data to show that Solana is second only to Ethereum in terms of developer activity, despite experiencing periods of downtime.

Insights from the newsletter also delve into specific projects and trends within the Solana ecosystem. For example, the GenesysGo overview highlighted the project's resilience and potential for growth amidst market volatility.

The newsletter has also covered the emergence of SocialFi on Solana, cautioning users about the associated risks while highlighting the rapid growth of platforms like Friendzy. The growth of Solana's stablecoin and liquid staking token (LST) ecosystem was another focal point, indicating a healthy development of DeFi products despite a slight quarter-over-quarter decrease in the stablecoin market cap.

Lastly, the analysis of Star Atlas revealed it as a "sleeping giant" within the gaming sector on Solana, with a strong community and significant transaction volume.

In summary, if you want quality insightful content on the Solana ecosystem subscribing to the Step Data Insights Newsletter is a no-brainer.

Solana Floor

At this point, you may already know that all crypto degens hang out on Twitter/X. We call our distinct group CT(Crypto Twitter). On CT you can follow the SolanaFloor account to stay ahead of the curve on all Solana happenings.

Just like Batman hangs out in Bat Cave, and Aquaman in Atlantis, Solana manlets are always on Solana floor for the latest news about the ecosystem.

Along with Solana news, it also has token and NFT prices and details about all the upcoming Solana events.

The Next Billion

The Next Billion podcast is aimed at helping crypto adoption for the next billion users, the podcast has some in-depth discussions with builders who will bring this adoption,

One of the key themes of the pod is the transformation of payment infra through crypto. In one of their episodes, they discuss how crypto is accelerating global blockchain adoption and transforming real-world payments on Solana.

There are also episodes about Web3 gaming and its potential to redefine economies and empower individuals in the blockchain era.

Another episode discusses the transition from Web2 to Web3 and the challenges of onboarding people into the Web3 ecosystem.

Beyond crypto, the channel also discusses broader issues related to technology and society. For instance, one episode discusses the challenge of connecting the unconnected population to next-generation 5G technology. Another episode features Payal Arora, who shares her insights from immersing herself in various communities around the world.

In summary, The Next Billion is a forward-thinking YouTube channel that explores the future of technology, with a particular focus on blockchain, cryptocurrency, and the digital economy.

Solana Crossroads

The Solana Crossroads event is an annual community conference hosted by Step Finance.

The 2024 conference is set to be the largest to date, with an expected attendance of 3,000 people. The event will take place in Istanbul, Turkey, from May 10 to May 11, 2024, at the Hilton Bosphorus.

The event aims to bring together the brightest minds in crypto for educational sessions, networking, and celebrations.

The conference will feature speakers from various Solana projects and the Solana Foundation. Some of the announced speakers include Coingecko co-founder Bobby Ong, Solana project founders such as Michael Wagner of Star Atlas, Superteam co-founder Kash Dhanda, and leaders from the Solana Foundation who are yet to be announced. Swick Samo from the Samoyed Coin team and SamoDAO will also be presenting at the event.

The Solana Crossroads event is part of Step’s broader effort to foster community engagement and growth.

Solana Allstars

The Solana Allstars program is a community-driven initiative designed to foster engagement and education within the Solana ecosystem. It's inspired by the Binance Angels program, which has been successful in promoting Binance through local events hosted by dedicated fans.

Here's a simplified explanation of what Solana Allstars entails:

Local Events: Solana Allstars organizes in-person gatherings, typically with 50 to 100 attendees, anywhere in the world. These events are led by community superfans who are part of the DAO.

Education and Onboarding: The focus of these events is to educate people about the Solana ecosystem and onboard new users. This helps grow the community and increase the adoption of Solana-based projects.

Partner Distribution: The program also serves as a way to introduce and distribute products from Solana's project partners to a wider audience.

Community Leadership: Each event is managed by an Allstar, a knowledgeable community member who can cultivate a high-quality local community and report back on event outcomes to the DAO.

Scalability: The program is designed to be scalable, allowing for expansion without the need for direct oversight from the core team or local knowledge.

Integration with Crossroads: Solana Allstars is closely linked with Crossroads, a larger event platform within the Solana community. The smaller Allstar events act as a funnel, leading up to the larger Crossroads conferences that occur a few times a year.

Launch and Promotion: The program has already kicked off, and at the launch of the DAO, there will be a showcase of a professionally made video from the first event in Nigeria.

In essence, Solana Allstars is a grassroots marketing and education campaign that leverages the enthusiasm of the Solana community to spread awareness and drive the adoption of Solana's technology and projects. It's a way to connect with potential users and developers on a personal level, providing them with the knowledge and tools they need to become active participants in the Solana ecosystem.

Step DAO

The Step DAO is a unique approach to decentralized autonomous organizations (DAOs), drawing inspiration from successful models like Superteam and SAMO DAO.

Unlike traditional DAOs that focus on governance or voting, Step DAO is centred around community engagement and productivity.

Here's a simplified explanation of what Step DAO is all about:

Unified Community: Step DAO serves as a single community hub for all Step Finance brands and projects.

Bounties for Micro Tasks: The DAO features bounties, paid in STEP tokens, for small tasks that benefit the DAO, the ecosystem, or partner projects. These tasks can be technical or non-technical. Each bounty will have specific criteria and guidelines, set by the Step team ensuring quality and relevance.

Regional Focus: Similar to Superteam's regional approach, Step DAO also emphasizes specific markets, allowing for targeted growth and development.

Development Throughput: The DAO aims to speed up the development of new products for all Step Finance projects. It does this by not solely relying on the technical throughput of the Step development team, but by leveraging the collective skills and efforts of the community.

In essence, Step DAO is a one-stop shop for all Step Finance brands and projects. It's a place where community members can come together to discuss, collaborate, and contribute to the growth and success of the ecosystem. It's a model that values productivity and engagement, offering bounties for tasks that directly benefit the DAO and its associated projects. This approach not only incentivizes participation but also fosters a sense of ownership and involvement among community members.

Conclusion

Step finance came out of a hackathon in 2021 with a vision to be the central location to track, visualise, aggregate and execute transactions across multiple smart contracts in the Solana ecosystem.

They soon added content creation as the core part of the strategy to onboard next billion users and help them understand the crypto world in a better way.

One of the core strength about the Step team is that they have successfully adopted good things from various ecosystems like Binance angels to Solana Allstars and Superteam to Step DAO. This shows the team’s strength in execution and their awareness about larger ecosystem happenings.

I personally think that Step Finance’s content game is the strongest with more than 30k followers on Twitter/X Solana Floor is one of the best accounts for all Solana related stuff.

It is rare to see a project perfoming well on both tech/product and distribution front and Step Finance has got most of the things right till now.

These are truly exciting times for Solana and Step Finance.

Sources

https://www.solanacrossroads.com/faq

https://www.reddit.com/r/solana/comments/zg550p/solana_crossroads_speaker_announcements_2023_event/

https://www.solanacrossroads.com

https://solana.com/news/solana-foundation-hackathon-colosseum-events

https://twitter.com/SolanaCrossroad/status/1734982279061987567

https://finance.yahoo.com/news/solana-bets-big-turkey-istanbul-153100275.html

https://www.studentcoin.org/coinpaper/solana-s-2024-predicted-to-start-with-a-70-price-surge

https://solana.com/news/solana-solstice-2023-community-review

https://coinpaper.com/2936/solana-s-2024-predicted-to-start-with-a-70-price-surge

https://solanafloor.com/news/breakpoint-2023-what-you-need-to-know

https://www.reddit.com/r/solana/comments/1af0rx3/star_atlas_ceo_takes_center_stage_at_solana/

https://www.youtube.com/@The_NextBillion/videos

https://twitter.com/SolanaFloor

https://www.step.finance/learn/compounding-on-step

https://www.step.finance/learn/how-to-use-step-finance